This token isn’t available on the OKX Exchange.

PT

Penguin Tarrif price

0x4463...4444

$0.000020882

-$0.00021

(-91.06%)

Price change for the last 24 hours

How are you feeling about PT today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

PT market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$20,882.27

Network

BNB Chain

Circulating supply

1,000,000,000 PT

Token holders

458

Liquidity

$17,501.08

1h volume

$3,989.89

4h volume

$21,835.47

24h volume

$1.01M

Penguin Tarrif Feed

The following content is sourced from .

Jonaso

Pendle Unlocking Pendle LPs (Pencosystem)

➥ @pendle_fi v2 has already established itself as a central liquidity hub across DeFi categories, optimizing yield and powering the rise of the points meta:

▸ ETH & BTC LST / LRT

▸ Yield bearing stablecoin (YBS)

▸ Tokenized asset (RWA)

▸ Trending narrative : sKAITO, sENA, ...

➥ As this foundation matures, Pendle continues pushing forward, setting new standards for both PT and LPs

Pendle PTs have already proven their value across DeFi with $2 billion in usage on platforms like Aave and Morpho, becoming a trusted collateral layer and a key part of many yield strategies

➥ Now, it’s time for Pendle LPs to take the spotlight

These LP assets combine fixed yield with Pendle incentives and are starting to gain traction

With @SiloFinance now accepting wrapped Pendle LPs as collateral, the ecosystem is opening up new yield opportunities

Pendle isn't just part of defi, it's helping shape its future

Neo Nguyen

You're getting bored with repetitive PT token looping strategies? We got @SiloFinance serving up a fresh DeFi dish for you!

Introducing the 1st ever @pendle_fi's LPs as collateral on a money market. Yep, you read that right- collateralize Pendle’s LP to borrow and unlock new possibilities! 🧵

10.63K

54

Jonaso

Pendle Unlocking Pendle LPs (Pencosystem)

➥ @pendle_fi v2 has already established itself as a central liquidity hub across DeFi categories, optimizing yield and powering the rise of the points meta:

▸ ETH & BTC LST / LRT

▸ Yield bearing stablecoin (YBS)

▸ Tokenized asset (RWA)

▸ Trending narrative : sKAITO, sENA, ...

➥ As this foundation matures, Pendle continues pushing forward, setting new standards for both PT and LPs

Pendle PTs have already proven their value across DeFi with $2 billion in usage on platforms like Aave and Morpho, becoming a trusted collateral layer and a key part of many yield strategies

➥ Now, it’s time for Pendle LPs to take the spotlight

These LP assets combine fixed yield with Pendle incentives and are starting to gain traction

With @SiloFinance now accepting wrapped Pendle LPs as collateral, the ecosystem is opening up new yield opportunities

Pendle isn't just part of defi, it's helping shape its future

Neo Nguyen

You're getting bored with repetitive PT token looping strategies? We got @SiloFinance serving up a fresh DeFi dish for you!

Introducing the 1st ever @pendle_fi's LPs as collateral on a money market. Yep, you read that right- collateralize Pendle’s LP to borrow and unlock new possibilities! 🧵

9.62K

0

ChainCatcher 链捕手

1. Circle IPO detonates a new cycle of stablecoins

In June 2025, Circle Internet Group successfully went public in the United States, and its stock price soared by about 168% on the first day, and rose by as much as 700% in a few days, with a market value of nearly $63 billion, becoming the strongest crypto concept stock of the year. This wave of rally demonstrates the market's strong pursuit and expectation of compliant stablecoins.

At the same time, USDC itself has maintained solid growth. As of June 26, USDC's circulating market capitalization has reached about $61.7 billion, with an average daily trading volume of more than $6.5 billion, ranking seventh in the global crypto asset market capitalization. The overall stablecoin sector performed strongly, with the total market capitalization of the top five stablecoins exceeding $250 billion, once again establishing its core position in the digital financial ecosystem.

The policy level is also continuing to be positive: the United States officially launched the GENIUS Act, which establishes a regulatory framework for stablecoins; The South Korean government announced the relaxation of restrictions on the issuance of local stablecoins, and many Asian countries have also begun to open up the approval of payment and clearing licenses. The combination of regulatory clarity and capital assistance is opening an unprecedented window of outbreak for stablecoin projects.

Stablecoins are no longer a tool to "peg to $1", but are evolving into a new generation of financial infrastructure that connects traditional financial assets with on-chain economic systems.

Source: Coinmetrics

2. Stablecoins began to pursue "real returns"

When the market has not yet fully shifted to the "income stablecoin" track, Cygnus has already laid out in advance.

At that time, Cygnus put forward a very different assumption from the mainstream route: stablecoins should not only be containers for pegging value, but also become low-risk, composable, and on-chain real yield assets for users. Under the guidance of this concept, Cygnus launched cgUSD, a stablecoin designed based on the daily rebase mechanism, which supports 1:1 redemption, and the underlying income comes from the combination of short-term U.S. Treasury bonds and on-chain high-credit assets, taking into account the yield, security, liquidity and composability. It is worth mentioning that the choice of this path occurred before the issuance of stablecoins of mainstream projects such as Ondo Finance, and Cygnus has taken the lead in completing the implementation of the stablecoin mechanism of "on-chain composable + treasury bond yield support", opening a new channel for the Real Yield model.

Further, Cygnus partnered with Pendle to launch wcgUSD's LP yield pool. Users can freely choose to lock in fixed income (PT) or win floating income (YT) to flexibly combine on-chain asset strategies. According to the latest official data from Pendle, as of the end of June 2025, the TVL of the wcgUSD pool exceeded 35M US dollars, and the annualized return was as high as 12%+, and it steadily ranked first in the stablecoin track in Pendle's new market, surpassing many leading projects.

From cgUSD's Rebase mechanism to high-yield pools on Pendle, Cygnus is truly productizing the "stability + yield" narrative and ushering stablecoins into a new era of Real Yield.

3. In addition to the "real", new opportunities and new dilemmas: The wave of AI stablecoins is coming

As AI technology continues to penetrate Web3, the stablecoin space has also opened a new narrative cycle – AI-powered stablecoins.

From Maitrix to GAIB and USDAI, a series of projects have tried to package income such as AI computing power leasing, model invocation fees, or data circulation incentives into the underlying asset logic of stablecoins. These attempts are expected to map the value of the AI world into the on-chain financial system, creating a new stable asset that is "intelligent and growable".

However, most AI stablecoin projects generally face the following problems:

Heavy on AI and light on Crypto, lacking on-chain governance and transparency;

Poor compatibility with existing DeFi protocols, making it difficult to access liquidity networks;

The model economy flywheel is highly dependent on the internal operation of AI and lacks a value anchoring mechanism.

Lack of governance and liquidation design to deal with extreme market conditions.

The essence of these problems is not the AI itself, but the lack of composable, verifiable, and sustainable DeFi soil for these projects. As a result, despite the novelty of the concept, stablecoins that can truly integrate AI into the on-chain financial system are still scarce.

4. The path of Cygnus: from Instagram Layer to the financial model of data sovereignty

Rather than simply chasing the AI craze, Cygnus fundamentally reconstructs the relationship between AI, social behavior, and finance, and proposes a new narrative framework: social as assets, behavior as credit, and AI-driven data financial models.

In order to bridge the gap between Web2 users and on-chain incentives, Cygnus first built the world's first Web3 Instagram Layer - InstaPlay. The module is natively connected to Instagram Graph, and through Account Abstraction (AA) technology, the user's Instagram account is a Web3 wallet. As a result, the "Account Fi" mode is enabled, so that Web2 behaviors such as likes, comments, and content publishing can be structurally mapped onto the chain to form measurable, composable, and collateral "behavioral assets".

This not only brings a new on-chain experience, but also captures the core value flow problem of the current wave of AI creators - when a large amount of AI content emerges on platforms such as Instagram, the real value is not effectively precipitated and fed back to the creators and users themselves. Through the synergistic mechanism of AI + Social, Cygnus fills the missing bridge between "content production→ user interaction→ value feedback": it binds AI-generated content to users' social behaviors, and then realizes a sustainable closed-loop of two-way income for creators and participants through an on-chain incentive model.

On top of this, Cygnus has also built a complete Creator Economy flywheel system:

Creators share content, participate in brand challenges, or initiate tasks in the Cygnus Instagram Layer;

Users can obtain behavior value and token incentives through interaction, and behavior will also be accumulated as credit data on the chain;

Brands can initiate on-chain tasks to achieve precise incentives for advertising and creation;

All social behaviors are precipitated into structured assets to build a "financial graph".

Cygnus' AI models are not used to predict markets or generate content, but rather serve the identification, structuring, and credit modeling of user behavior. The system automatically generates "behavior scores" from users' on-chain behavior data, social participation, content creation and other information, which can be used as on-chain credit certificates that can be used for staking, lending, or distributing incentives.

All data is owned by users, and users can freely choose to open, authorize, participate in DAO governance, or convert it into economic incentives, truly realizing a personal sovereignty system of "data as an asset".

Therefore, in the financial architecture of Cygnus:

AI is not a tool for extracting value, but an engine that activates the potential of user data;

The social behavior of creators and users is no longer free labor, but measurable, monetizable assets;

Creation and participation form the basis of credit, and the stablecoin cgUSD becomes the core value anchor of this system.

Cygnus is building a next-generation financial network driven by AI content + social engagement + on-chain/off-chain real returns, truly transferring value from the platform back to users.

Conclusion: The next stop of stablecoins is the valorization of people and behaviors

The future of stablecoins is no longer limited to pegging fiat currencies, nor is it limited to financial arbitrage structures. With the listing of Circle, the implementation of global policies, the rise of the AI ecosystem, and the increasingly prominent value of user behavior, stablecoins are evolving into the core components of a new generation of on-chain value bearing and incentive distribution mechanisms.

Instead of copying the traditional path, Cygnus has built a path with behavioral data as an asset, AI-driven credit generation, and real income as the underlying support from a longer-term perspective - through the combination of Instagram Layer, AccountFi, AI models and cgUSD, Cygnus is forming a closed-loop "new paradigm of social finance".

Rather than being a stablecoin project, Cygnus is more of a Web3 entry infrastructure tailored for Web2 users, and it is also the prototype of a rising, people-centric decentralized credit system.

The stablecoin of the future does not belong to banks or centralized enterprises, but to every user who is willing to share, participate and create value. Cygnus is laying the groundwork for this trend.

Show original2.7K

0

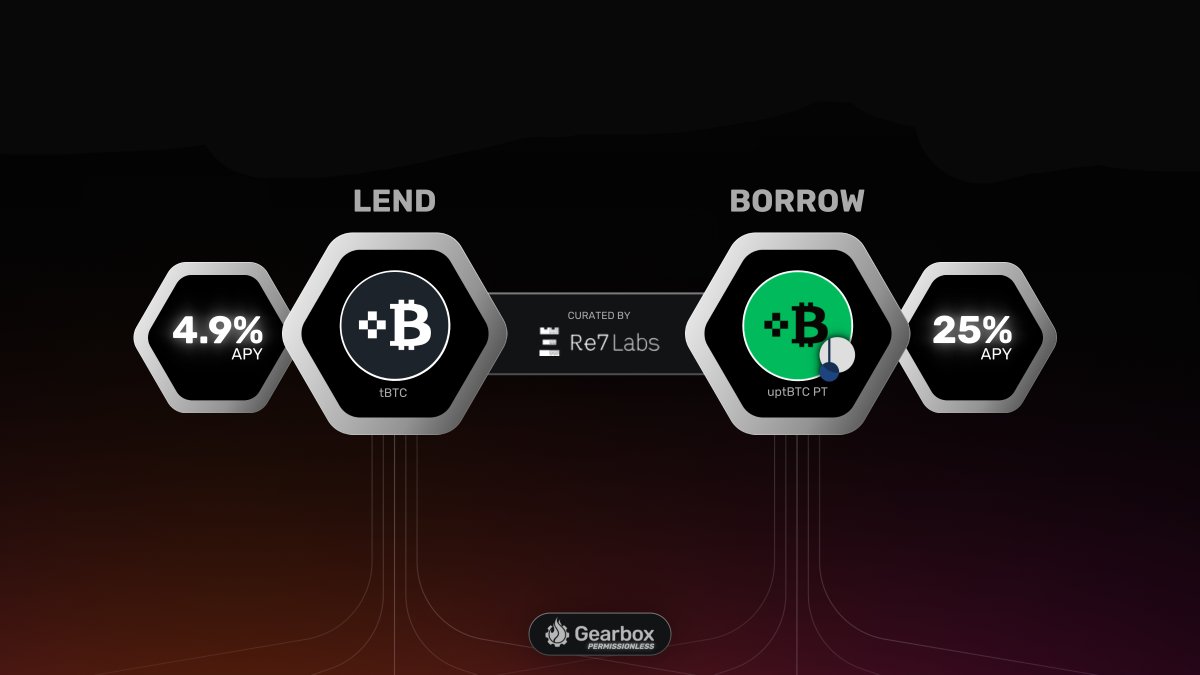

Gearbox ⚙️🧰 Protocol

Attending Cannes? Make sure your BTC works for you while you d̶r̶i̶n̶k̶ work for your protocol.

🧘♀️ Passively earn 4.9% APY by lending @TheTNetwork's tBTC

⏫ Or earn up to 25% APY on @pendle_fi's uptBTC PT with 6X leverage

Permissionlessly on @Re7Labs' BTCfi market. ⚙️🧰

Show original

5.59K

52

PT price performance in USD

The current price of penguin-tarrif is $0.000020882. Over the last 24 hours, penguin-tarrif has decreased by -91.06%. It currently has a circulating supply of 1,000,000,000 PT and a maximum supply of 1,000,000,000 PT, giving it a fully diluted market cap of $20,882.27. The penguin-tarrif/USD price is updated in real-time.

5m

+0.00%

1h

+9.77%

4h

+8.54%

24h

-91.06%

About Penguin Tarrif (PT)

PT FAQ

What’s the current price of Penguin Tarrif?

The current price of 1 PT is $0.000020882, experiencing a -91.06% change in the past 24 hours.

Can I buy PT on OKX?

No, currently PT is unavailable on OKX. To stay updated on when PT becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of PT fluctuate?

The price of PT fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Penguin Tarrif worth today?

Currently, one Penguin Tarrif is worth $0.000020882. For answers and insight into Penguin Tarrif's price action, you're in the right place. Explore the latest Penguin Tarrif charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Penguin Tarrif, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Penguin Tarrif have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.