This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

SRM

SRM Entertainment price

3LNJzp...3Jij

$0.000081964

-$0.00032

(-79.73%)

Price change for the last 24 hours

How are you feeling about SRM today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

SRM market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$81,964.01

Network

Solana

Circulating supply

1,000,000,000 SRM

Token holders

6209

Liquidity

$40,958.99

1h volume

$221,609.67

4h volume

$1.04M

24h volume

$17.13M

SRM Entertainment Feed

The following content is sourced from .

0xMoon

What is killing three birds with one stone: the gold content and prospects of the TRON microstrategy

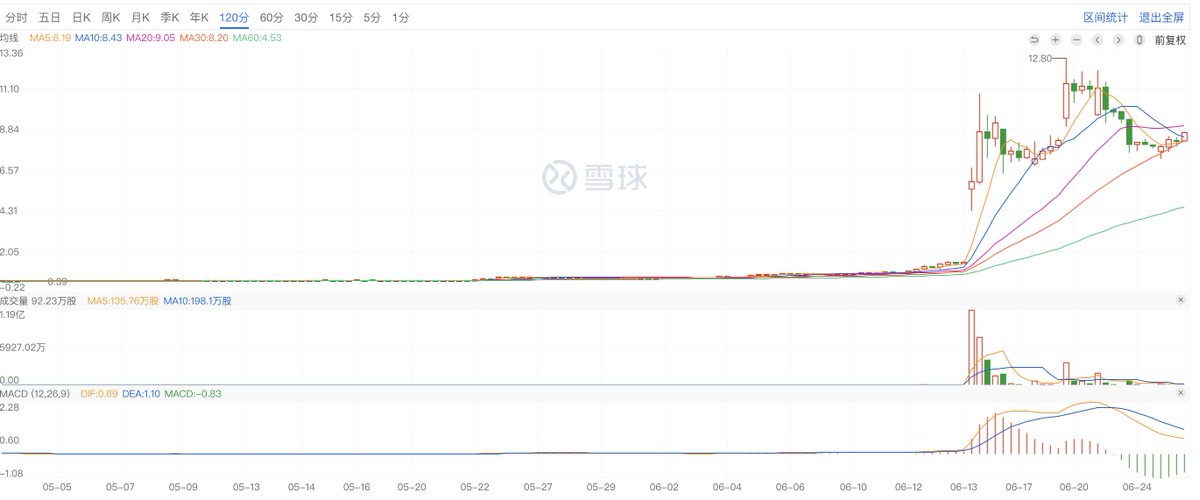

Recently, everyone knows that TRON has reached a reverse merger and listed on the U.S. stock market through cooperation with NASDAQ-listed SRM, and SRM will reproduce the "Bitcoin micro-strategy" model to open the "TRON micro-strategy", and include TRX as a reserve asset in the balance sheet to open the coin hoarding mode. After the news broke, SRM's stock price quickly jumped 11 times to $12.8.

So do you know why it's so crazy?

First of all, I need to explain to you that Bitcoin MicroStrategy is a company called MicroStrategy that continuously increases its holdings of Bitcoin as a long-term corporate asset reserve by issuing convertible bonds and raising funds from equity.

So what are the results of this strategic deployment?

MicroStrategy first bought Bitcoin in August 2020, buying 21,454 Bitcoin for $250 million to open its strategic reserve, and so far MicroStrategy holds a total of 592345 Bitcoin, with a total value of $64 billion and an average cost of $70,681.

It has been nearly five years since the start of the Bitcoin Strategic Reserve, and the stock price of MicroStrategy has risen from $11.78 to a maximum of $543, holding about 2.9% of the total Bitcoin, and the purchased Bitcoin has a floating profit

$22 billion.

It's as if history is playing out again on SRM and TRX

The current stock price of SRM is about $8.7, which is very close to the stock price when MicroStrategy launched the Bitcoin strategy, and both follow the same model, Bitcoin MicroStrategy and TRX MicroStrategy are targeting two different mainstream tokens.

In five years, the stock price of MicroStrategy has risen more than 50 times to 100 billion market value, and the price of Bitcoin has increased 10 times, so will SRM and TRX, which have smaller market capitalizations, create a higher increase myth?

@justinsuntron #TRONEcoStar @trondaoCN

Show original

15.16K

19

EnHeng嗯哼

July is the month of major events, and the global capital market has become Brother Sun's home turf

The Tron ecosystem continues to expand, with the issuance of USDT exceeding 80 billion, accounting for 51.6% of the total issuance of the entire network, and firmly occupying the position of the supremacy of stablecoins on the chain

What's more, even the world's most liquid and highest-profile U.S. stocks can now directly buy Tron micro-strategy, and where there is a demand for capital flow, Brother Sun will appear there

Brother Sun's Tron merger with SRM continues to operate at the atmospheric level, and the transaction volume has even surpassed Alibaba's. Among the cryptocurrency constituents, Tron Micro Strategy topped the list with the strongest gains, leading the @justinsuntron

Show original

17.01K

88

塞哥

Recently, many teachers have been posting about how Jump and Aptos have jointly launched Shelby, which feels reminiscent of when Jump created Serum on Solana back in the day.

If FTX hadn't collapsed, Serum would now be the Hyperliquid of Solana. What about Raydium and Jupiter... it's a pity there are no 'ifs'.

In the leading version, Shelby is the infrastructure created by Jump, while Aptos has become the public chain carrier this time.

Keep an eye on Jump's movements; if there's an opportunity, get in. Jump won't let any of its believers down.

Aptos

Storage is broken. Big Tech controls data. Web3 can't rely on Web2 infra. It ends now.

@ShelbyServes, Web3's 1st cloud-grade infra, by @jump_ @AptosLabs.

Decentralized, monetizable storage for data-rich apps.

Hot by design. Chain-agnostic. Incentivized.

2.55K

4

cutepanda

Yuyue's idea is really worth taking a look at

In retrospect, the biggest progress for me in the cryptocurrency circle is that I have changed from a novice who knows nothing to a little bit of investment thinking

In the future, no matter what happens in the cryptocurrency circle, I will try to diversify into different areas in terms of assets and benefit for a lifetime

Yuyue

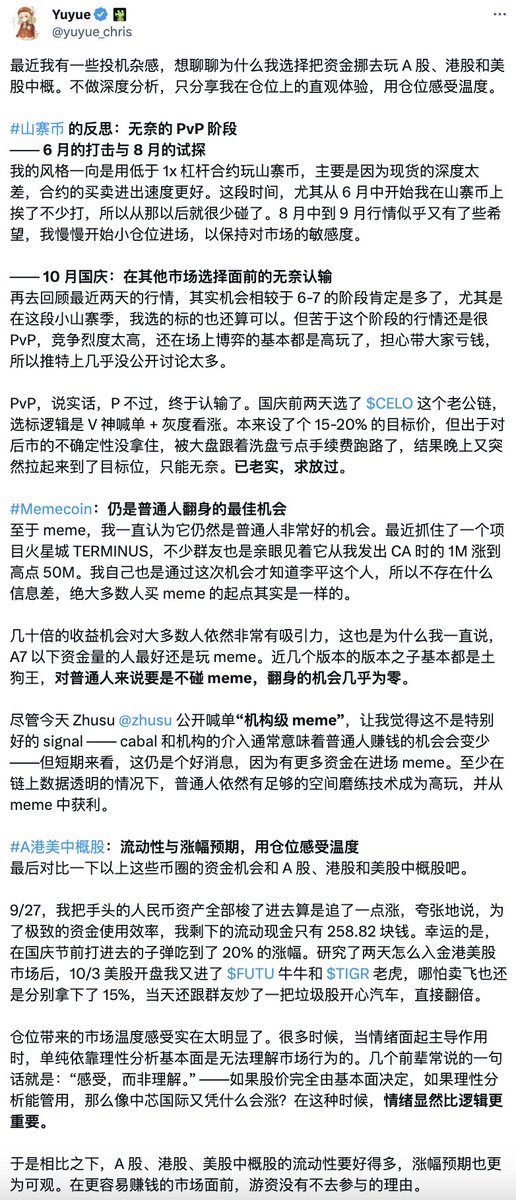

After October 2024, Kay, Kay, and a few friends who withdrew money to play A-share U.S. stocks and Hong Kong stocks were "slapped in the face" by the rally in the currency circle, and this decision was ridiculed by some other friends, just because we withdrew some funds from the currency circle and switched to U.S. and Hong Kong stocks 😂. Indeed, after that, A-shares and Hong Kong stocks experienced a pullback, and the currency circle ushered in a wave of bulls, but I still have no regrets: leaving the market at the right time is my deliberate choice

Some people say that before the demon stocks of Hong Kong stocks and U.S. stocks soared, people in the currency circle had never even heard of tickers. I disagree. A few examples:

- Michelle Bingcheng, Overlord Tea Queen, who hasn't drunk this cup of "familiar strange tea"? Snow King is new, and the big money in the currency circle and the new studio have long been rushing

- Bubble Mart, Wang Ning's trendy toy empire, which young person doesn't know? But chasing up is a matter of guts, not when you know the information

- $CRCL, $SBET, $SRM, and even the $NA just now, the news in the currency circle is definitely first-hand, and the chase has doubled after the news comes out

The world is not a diode, you can't speculate on coins if you don't play U.S. stocks, and you can't play U.S. stocks if you speculate on earth dogs. The key is not to choose sides, but to manage positions and energy

- People in the currency circle have switched to U.S. stocks, with fast information collection and a keen sense of smell in news trading, especially in the Trump market (the White House stock god who shouts orders, knows everything), and the reaction speed crushes traditional traders

-- The outbreak of the stablecoin narrative started with the US stock market

- The native meme and alpha of each chain in the cryptocurrency circle are still a paradise for small funds, but when the amount of funds is enlarged, sometimes hundreds of thousands of U's positions in altcoins may be the fish of others

-- Of course, BTC is an absolute mainstream, of course, with first-class volatility, first-class capital capacity, and stability, but it must be a little worse than the U.S. stock demon stock in terms of multiples

Both choices are correct, it depends on how to allocate positions, give full play to the endowment, and find your own optimal path. Trading is like life, and every decision is a projection of your three views, personality, and endowment. The doubling of the demon stocks of U.S. and Hong Kong stocks, and the meme carnival in the currency circle are just a corner of the market. There are also many people who lose money in U.S. stocks, and some people play meme as a slot machine and embark on the road of no return to take out loans and debts

Other people's decisions are just a reference answer for you and me, and don't regard the gains of others as your own losses. My reference answer is: 70% energy allocation is to fight dogs, 20% to see major mainstream bands such as BTC ETH SOL, and 10% to US stocks and Hong Kong stock opportunities; Funds are flexible and do not set their own limits

------

Attached are some relevant past essays:

P1: 2024/10/6, since then, the cryptocurrency circle has ushered in the AI frenzy of $GOAT, the political meme $PNUT and $ACT are listed on Binance together, and the end of $TRUMP. On the side of Hong Kong stocks, the value of Xiaomi, Bubble Mart and other stocks was discovered. It wasn't until recently that $CRCL $SBET $SRM and other demon stocks appeared, and the cryptocurrency circle began a wave of collective argument that "copycat season happens in U.S. stocks".

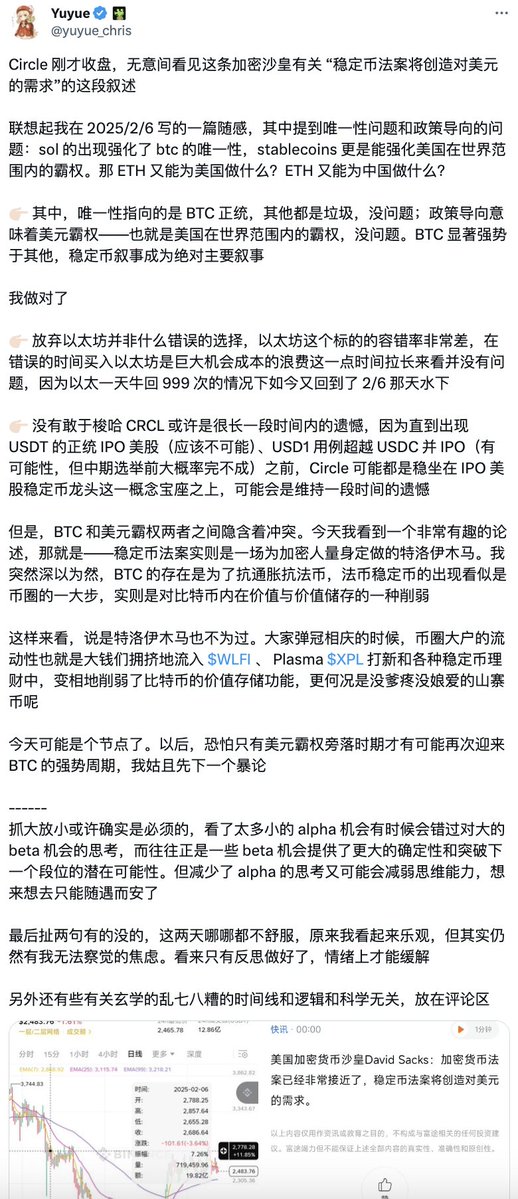

P2: 2024/6/19, incomplete thinking on the BTC and stablecoin narrative, balancing "big" and "small", the decision-making system between alpha and beta still needs more optimization

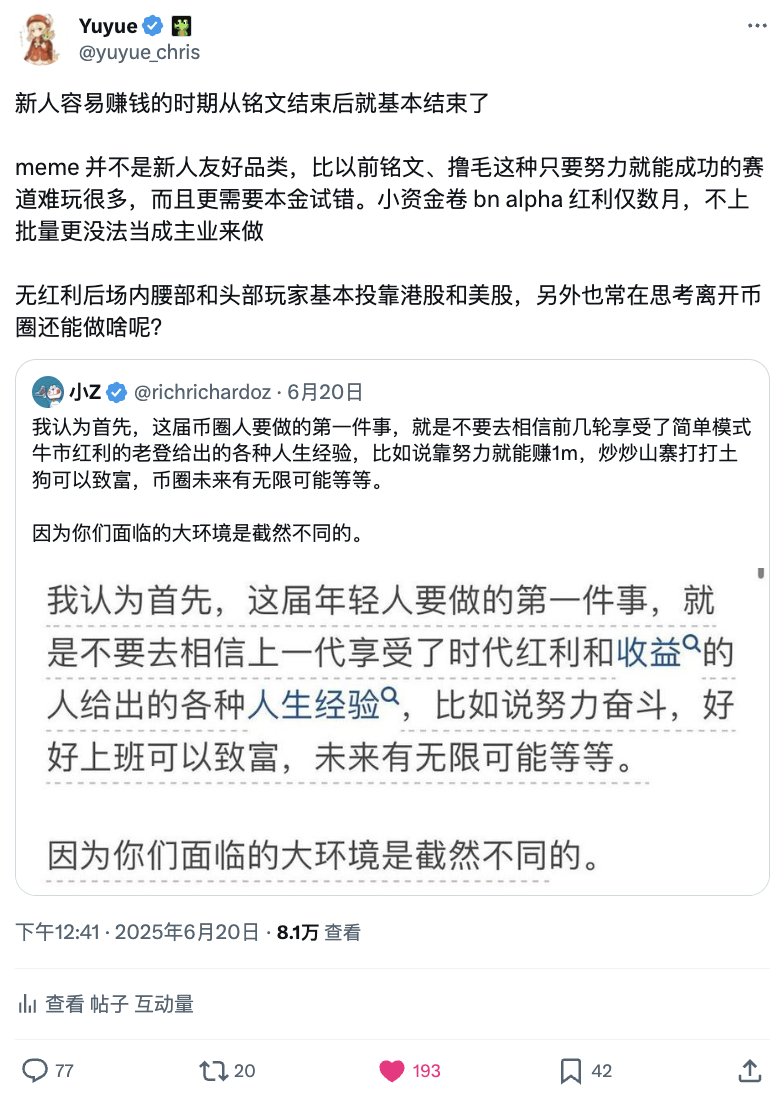

P3: 2025 / 6 / 20, the big bonus period of the currency circle has been fading objectively speaking, the hair track is basically over, and the meme track needs stronger technology and sense of smell. It's just that the road from novice to expert must be more difficult to walk due to the reduced fault tolerance

P4: Ethereum is still 2400 after returning from half a lifetime, and Ethereum's predicament is a microcosm of all large-cap altcoins in the cryptocurrency circle - very few altcoins have come out of ATH in the past six months

32.57K

14

Yuyue

After October 2024, Kay, Kay, and a few friends who withdrew money to play A-share U.S. stocks and Hong Kong stocks were "slapped in the face" by the rally in the currency circle, and this decision was ridiculed by some other friends, just because we withdrew some funds from the currency circle and switched to U.S. and Hong Kong stocks 😂. Indeed, after that, A-shares and Hong Kong stocks experienced a pullback, and the currency circle ushered in a wave of bulls, but I still have no regrets: leaving the market at the right time is my deliberate choice

Some people say that before the demon stocks of Hong Kong stocks and U.S. stocks soared, people in the currency circle had never even heard of tickers. I disagree. A few examples:

- Michelle Bingcheng, Overlord Tea Queen, who hasn't drunk this cup of "familiar strange tea"? Snow King is new, and the big money in the currency circle and the new studio have long been rushing

- Bubble Mart, Wang Ning's trendy toy empire, which young person doesn't know? But chasing up is a matter of guts, not when you know the information

- $CRCL, $SBET, $SRM, and even the $NA just now, the news in the currency circle is definitely first-hand, and the chase has doubled after the news comes out

The world is not a diode, you can't speculate on coins if you don't play U.S. stocks, and you can't play U.S. stocks if you speculate on earth dogs. The key is not to choose sides, but to manage positions and energy

- People in the currency circle have switched to U.S. stocks, with fast information collection and a keen sense of smell in news trading, especially in the Trump market (the White House stock god who shouts orders, knows everything), and the reaction speed crushes traditional traders

-- The outbreak of the stablecoin narrative started with the US stock market

- The native meme and alpha of each chain in the cryptocurrency circle are still a paradise for small funds, but when the amount of funds is enlarged, sometimes hundreds of thousands of U's positions in altcoins may be the fish of others

-- Of course, BTC is an absolute mainstream, of course, with first-class volatility, first-class capital capacity, and stability, but it must be a little worse than the U.S. stock demon stock in terms of multiples

Both choices are correct, it depends on how to allocate positions, give full play to the endowment, and find your own optimal path. Trading is like life, and every decision is a projection of your three views, personality, and endowment. The doubling of the demon stocks of U.S. and Hong Kong stocks, and the meme carnival in the currency circle are just a corner of the market. There are also many people who lose money in U.S. stocks, and some people play meme as a slot machine and embark on the road of no return to take out loans and debts

Other people's decisions are just a reference answer for you and me, and don't regard the gains of others as your own losses. My reference answer is: 70% energy allocation is to fight dogs, 20% to see major mainstream bands such as BTC ETH SOL, and 10% to US stocks and Hong Kong stock opportunities; Funds are flexible and do not set their own limits

------

Attached are some relevant past essays:

P1: 2024/10/6, since then, the cryptocurrency circle has ushered in the AI frenzy of $GOAT, the political meme $PNUT and $ACT are listed on Binance together, and the end of $TRUMP. On the side of Hong Kong stocks, the value of Xiaomi, Bubble Mart and other stocks was discovered. It wasn't until recently that $CRCL $SBET $SRM and other demon stocks appeared, and the cryptocurrency circle began a wave of collective argument that "copycat season happens in U.S. stocks".

P2: 2024/6/19, incomplete thinking on the BTC and stablecoin narrative, balancing "big" and "small", the decision-making system between alpha and beta still needs more optimization

P3: 2025 / 6 / 20, the big bonus period of the currency circle has been fading objectively speaking, the hair track is basically over, and the meme track needs stronger technology and sense of smell. It's just that the road from novice to expert must be more difficult to walk due to the reduced fault tolerance

P4: Ethereum is still 2400 after returning from half a lifetime, and Ethereum's predicament is a microcosm of all large-cap altcoins in the cryptocurrency circle - very few altcoins have come out of ATH in the past six months

Show original

86.9K

169

SRM price performance in USD

The current price of srm-entertainment is $0.000081964. Over the last 24 hours, srm-entertainment has decreased by -79.73%. It currently has a circulating supply of 1,000,000,000 SRM and a maximum supply of 1,000,000,000 SRM, giving it a fully diluted market cap of $81,964.01. The srm-entertainment/USD price is updated in real-time.

5m

+0.15%

1h

-93.21%

4h

-97.90%

24h

-79.73%

About SRM Entertainment (SRM)

SRM FAQ

What’s the current price of SRM Entertainment?

The current price of 1 SRM is $0.000081964, experiencing a -79.73% change in the past 24 hours.

Can I buy SRM on OKX?

No, currently SRM is unavailable on OKX. To stay updated on when SRM becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of SRM fluctuate?

The price of SRM fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 SRM Entertainment worth today?

Currently, one SRM Entertainment is worth $0.000081964. For answers and insight into SRM Entertainment's price action, you're in the right place. Explore the latest SRM Entertainment charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as SRM Entertainment, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as SRM Entertainment have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.