Download OKX Institutional Basis Trading Report

Unlock the secrets of Basis Trading

We are pleased to present this inaugural Basis Trading report, which delves into the the trading ideas and insights on cryptocurrency Basis Trading market. Basis trading has long been favored by institutional crypto traders due to its potential for arbitrage opportunities, which allows traders to exploit price differentials, utilize leverage, and hedge their exposure effectively. Meanwhile, the dynamics of basis movement and market structure also provide valuable insights into market trends and offer some attractive trading opportunities.

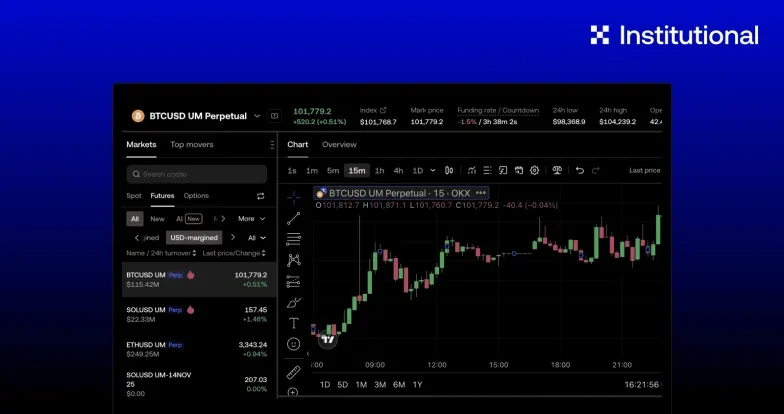

As the crypto industry evolves, so do the tools available for basis trading. For instance, the emergence of advanced trading platforms like OKX's Nitro Spreads has led to improved capital efficiency, reduced execution friction, and an elevated user experience. These advancements have opened up new possibilities for traders to maximize their potential returns.

In this report, we aim to share data-driven insights and top trading ideas/strategies from our esteemed institutional clients who have excelled in the crypto market. Through their expertise and successful track records, we hope to shed light on the nuances of basis trading and provide valuable guidance for traders looking to navigate this dynamic landscape.

We would like to extend our gratitude to our esteemed institutional clients for their valuable contributions to this report. Their expertise and insights have been instrumental in shaping the content and ensuring its relevance to the current crypto market.

We hope you find this report informative and insightful as you explore the world of basis trading in the crypto market.

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” Some content may be generated or assisted by artificial intelligence (AI) tools. No derivative works or other uses of this article are permitted.