Ethereum RWA Explosion: Regulatory Changes and a New Growth Engine

Original title: "IOSG Weekly Brief|Ethereum RWA Explosion: Regulatory Changes and New Growth Engine #278"

Original Author: Sam, IOSG Ventures

TL; TL;DR:

Take the stablecoin bill as an introduction, introduce the recent public attention and discussion on RWA, and then start talking about the RWA data analysis on Ethereum (zksync can be used as a highlight) What impact will the emergence of Etherealize have on Ethereum Ethereum's stablecoin issuance and DeFi have always had a strong moat, combined with the new policy of the United States, can traditional finance and DeFi be organically linked through RWA, As the most trusted and decentralized blockchain, we continue to be bullish on Ethereum's point where the

bill catalyzes and the market attention

Against the backdrop of a rapidly evolving traditional financial and regulatory environment, the recent passage of the GENIUS Act has reignited interest in RWAs. In addition to stablecoins and major legislative developments, the RWA space has quietly reached a number of important milestones: continued strong growth and a series of notable breakthroughs – such as Kraken's launch of tokenized stocks and ETFs, Robinhood's proposal to the U.S. Securities and Exchange Commission (SEC) to give token assets the same status as traditional assets, and Centrifuge's $400 million decentralized JTRSY fund on Solana.

At a time when market attention is at an all-time high and the wider adoption of traditional finance is just around the corner, it's important to take a deep look at the current RWA landscape – and especially the status of leading platforms like Ethereum. Ethereum-based RWA has shown impressive month-on-month growth, often maintaining double-digit highs; Growth in 2025 will accelerate even faster than in 2024, when it was a single-digit month. Another key factor driving this momentum is Etherealize as a catalyst for regulatory development, and the Ethereum Foundation's strategic focus on RWA. At this critical juncture, this article will take a deep dive into the evolution of RWA on Ethereum and its Layer-2 network.

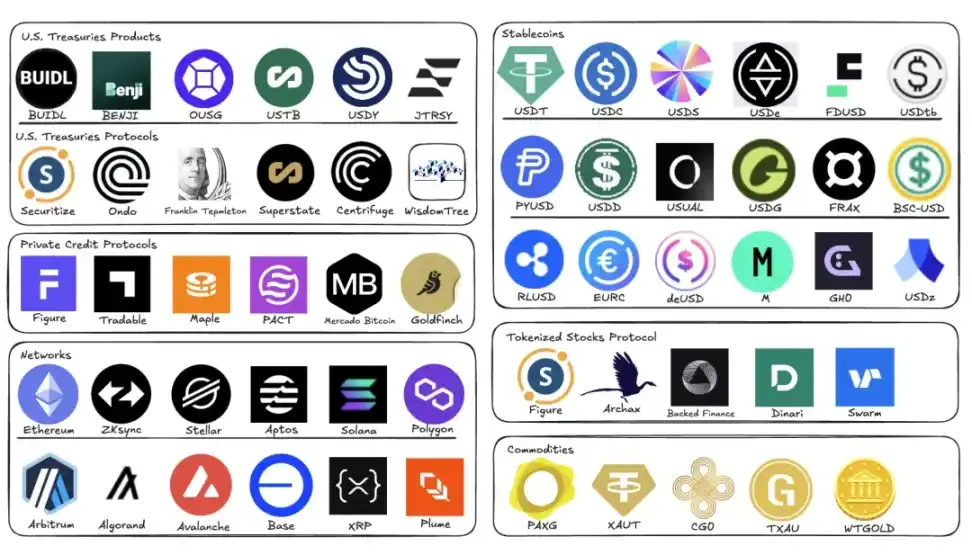

RWA Ecosystem Map, IOSG

Data Analysis: A Panoramic View of Ethereum RWA Growth

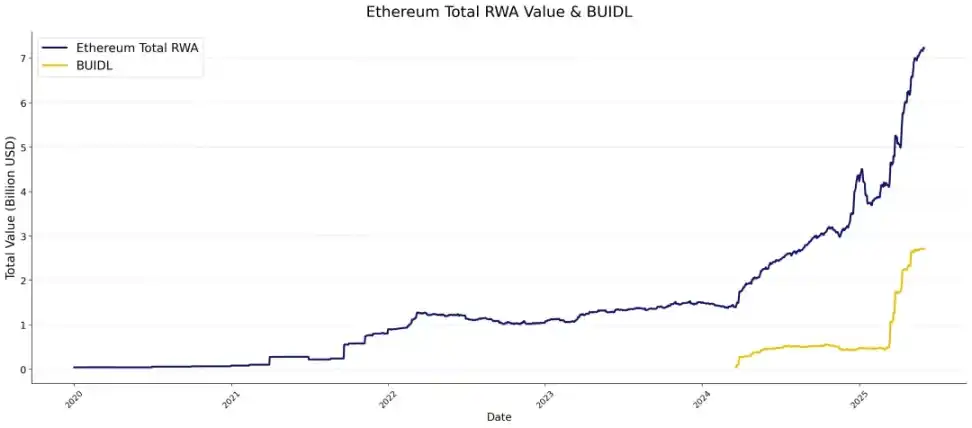

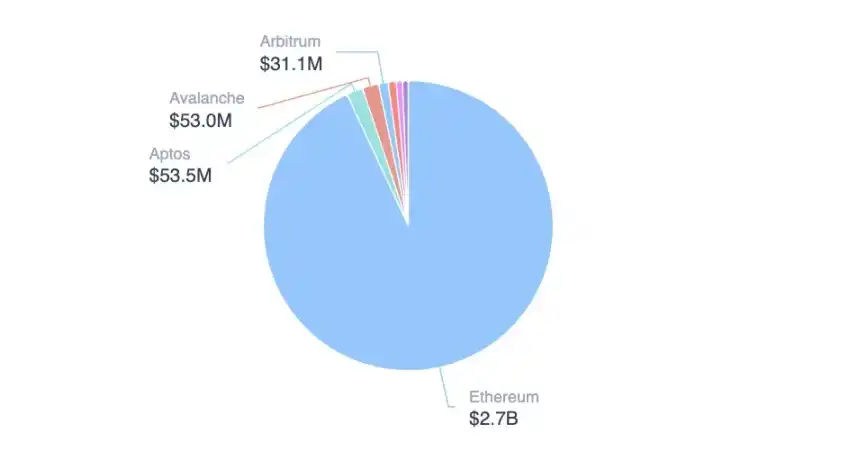

The data clearly shows that Ethereum's RWA value has entered a clear growth cycle. Looking at the total value of Ethereum's non-stablecoin RWA, the long-term trajectory is striking – it has remained in the $1 billion to $2 billion range for many years until it enters a phase of rapid growth in April 2024. This growth momentum continues to accelerate through 2025. The core driver is BlackRock's BUIDL fund, which is now worth $2.7 billion. As shown by the orange trend line, BUIDL itself has shown parabolic growth since March 2025, driving the overall expansion of the Ethereum RWA ecosystem.

RWA.xyz, IOSG

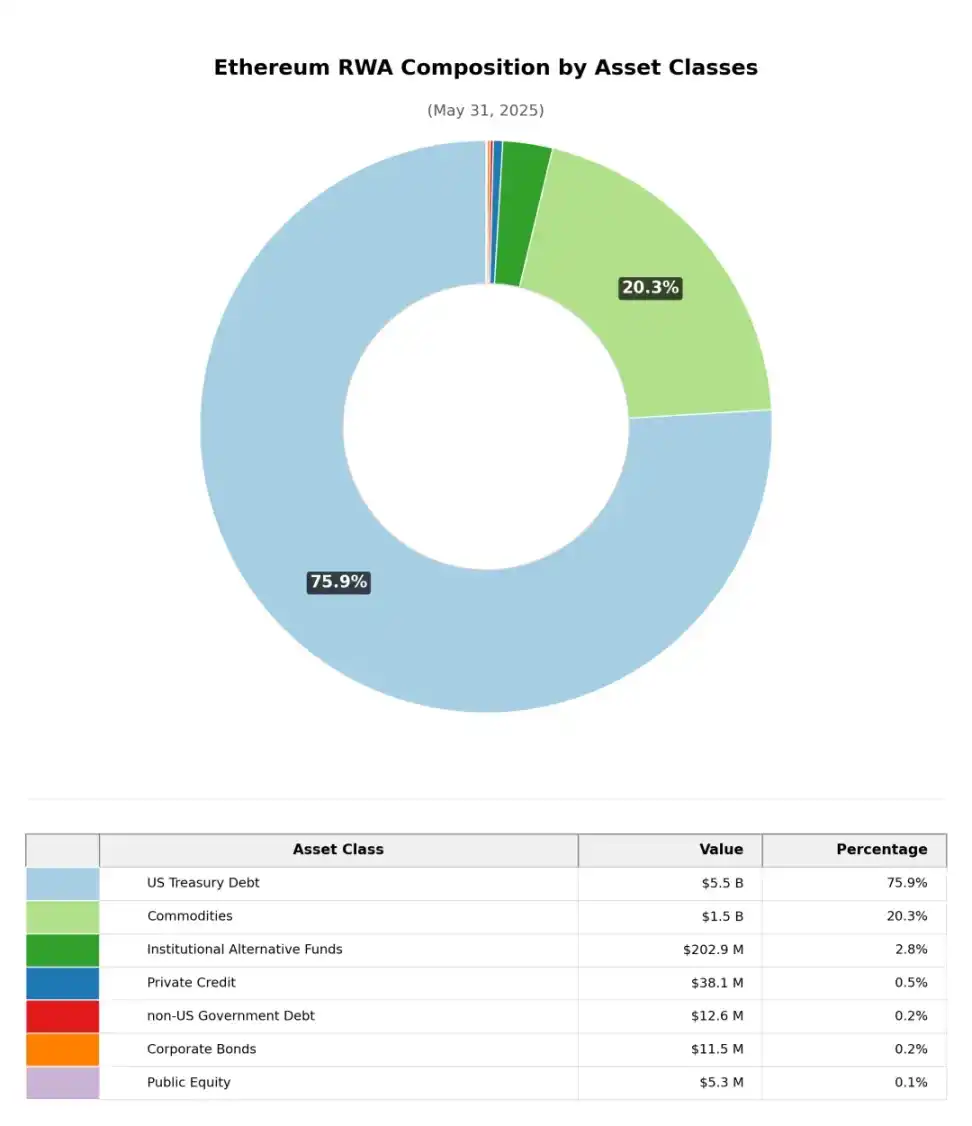

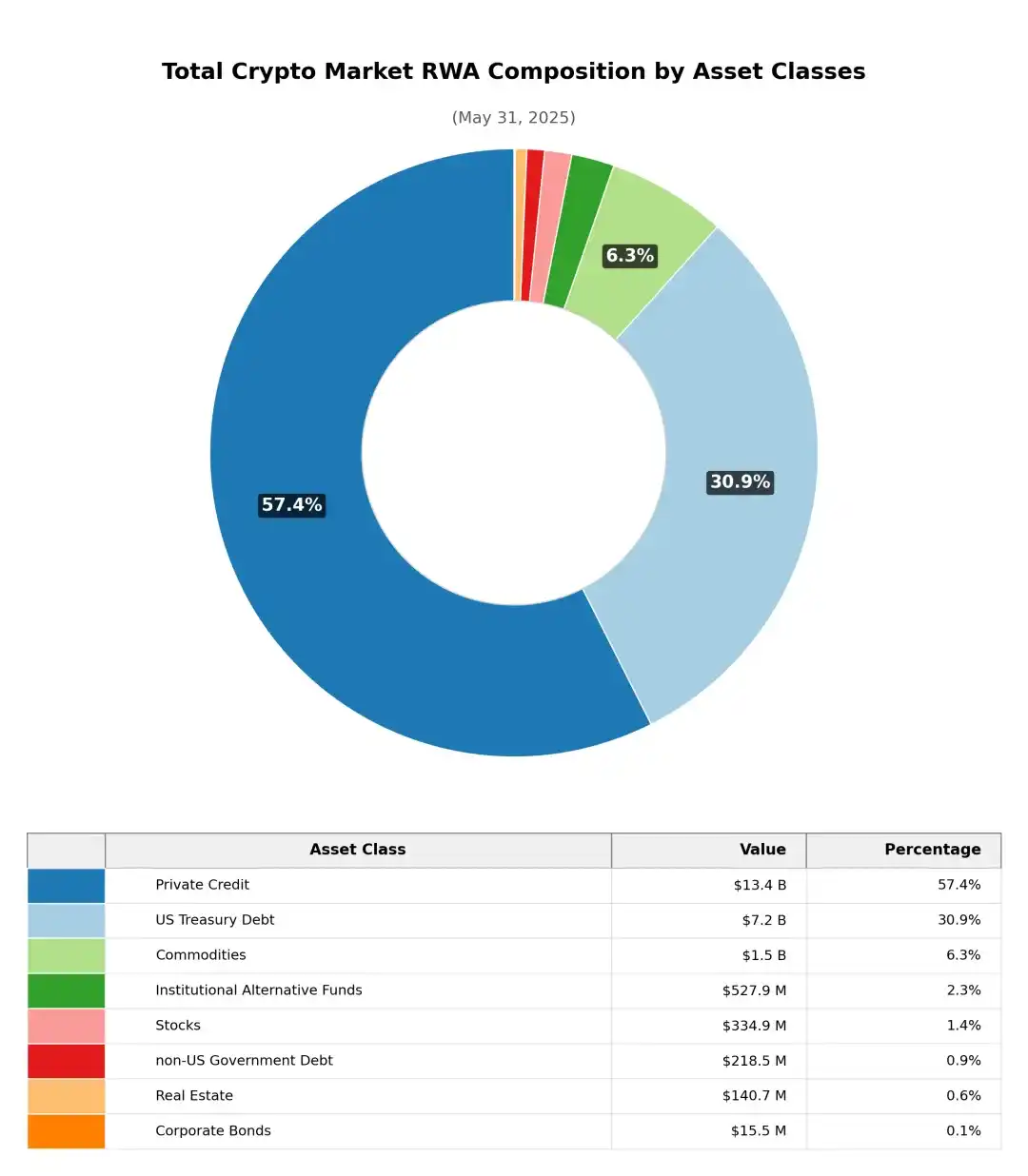

by asset class (excluding stablecoins), the market capitalization of real world assets (RWAs) on Ethereum is highly concentrated in two main categories: Treasury projects (75.9%) and commodities (mainly gold, 20.3%), with other categories accounting for a small amount. In contrast, private credit accounts for the highest proportion of RWA market capitalization in the overall crypto market (57.4%), followed by Treasury projects (30.9%).

RWA.xyz, IOSG

RWA.xyz, IOSG

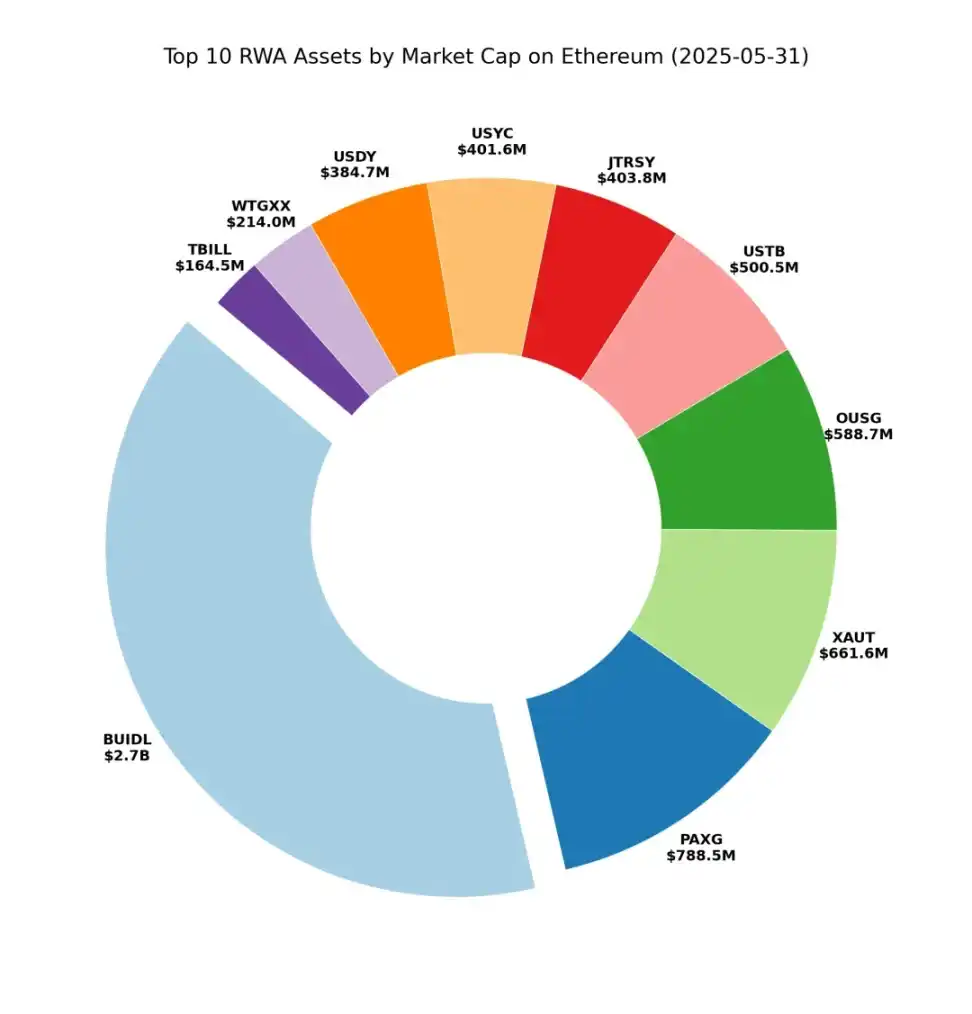

Further focusing on the top assets of Ethereum RWA, the pie chart clearly reveals the dominance of BUIDL. Looking back a year ago, the comparison shows that BUIDL was comparable in scale to PAXG, XAUT and other products, and now it has formed a significant surpass. Although the composition of the top 10 projects is basically stable, the growth rate of treasury bond products is significantly ahead of that of gold products, and the market share continues to expand.

RWA.xyz, IOSG

RWA.xyz, IOSG

From the perspective of protocols, the current leaders are mainly stablecoin issuers - the top four protocols are Tether, Circle, MakerDAO (Dai stablecoin system) and Ethena. It is worth noting that the total value of the securitization protocol Securitize has significantly surpassed some stablecoin projects such as FDUSD and USDC, and has jumped to the top. Other securities protocols in the top 10 include Ondo and Superstate.

RWA.xyz, IOSG

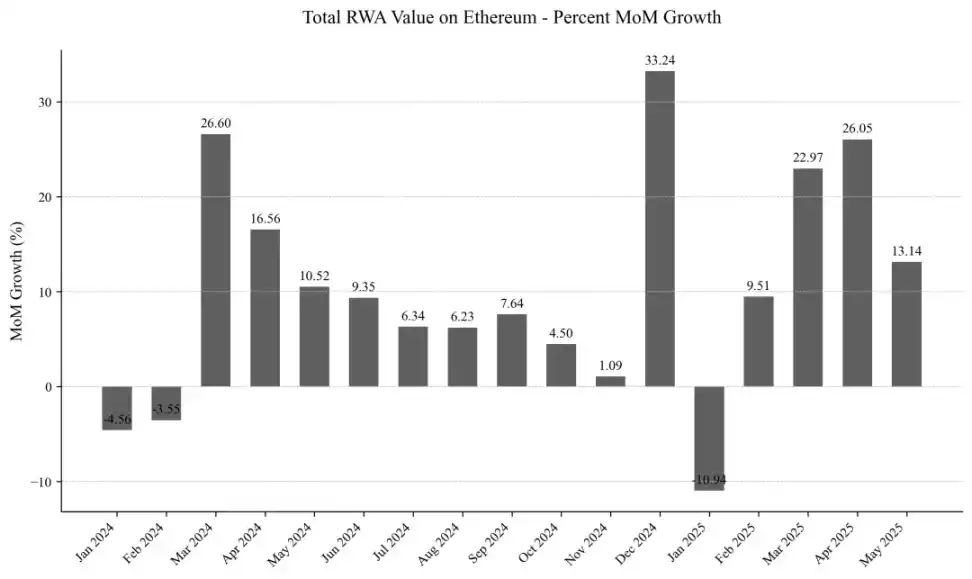

focuses on month-to-date data for 2024, with a wave of growth starting in April 2024 and achieving a staggering 26.6% increase in the month – contributing a quarter of the total incremental Ethereum RWA in a single month. This momentum continued into the next three months, and although it slowed slightly between August and December 2024, the network still maintained an increase of about $200 million per month (about 5% QoQ and over 60% annualized).

Growth exploded again in January 2025, surging 33.2% month-on-month. After a brief correction in February, Ethereum maintained double-digit growth for four consecutive months, with month-on-month growth exceeding the 20% mark in April and May.

RWA.xyz, IOSG

BUIDL

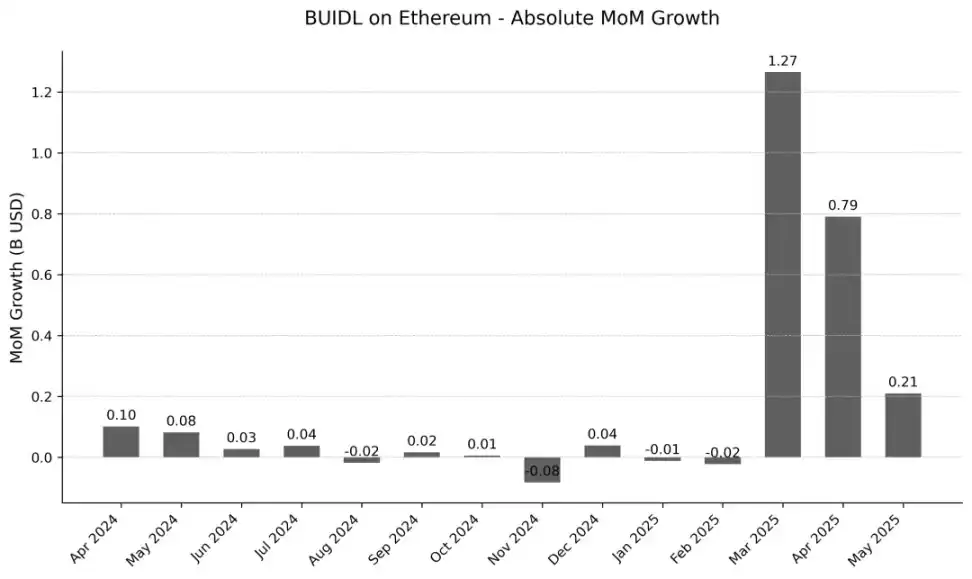

With BUIDL's rapid rise to become the largest project in the Ethereum RWA ecosystem by market capitalization, a detailed understanding of its growth path is crucial. The month-on-month growth chart reveals that the indicator remained relatively stable through March 2025 and then showed an explosive jump in March 2025. However, the latest May data shows that the ultra-fast growth trend has slowed slightly, but there is still an increase of $210 million, an increase of 8.38% month-on-month. Developments in the coming months are a key window to watch – we need to track whether growth continues to slow or continues to grow explosively.

RWA.xyz, IOSG

BUIDL's explosive growth stems from multiple factors. The growth was largely driven by institutional demand, and the competitiveness of the products was a key driver of success: 24/7 operations, faster settlement than traditional finance, and high yields within a compliance framework. Notably, DeFi integrations are realizing synergies and unlocking more utility, such as Ethena Labs' USDtb product, which has 90% of its reserves backed by BUIDL. At the same time, the recognition of BUIDL as a high-quality collateral continues to grow, and the launch of sBUIDL by Securitize further unlocks the DeFi integration scene.

BUIDL's asset distribution is highly concentrated: about 93% is concentrated on the Ethereum mainnet, which is difficult for other ecosystems to achieve. At the same time, as AUM continues to expand, BUIDL's monthly dividend has reached a new high, reaching $4.17 million in March 2025 and soaring to $7.9 million in May.

BUIDL distribution, screenshot from RWA.xyz

stablecoins

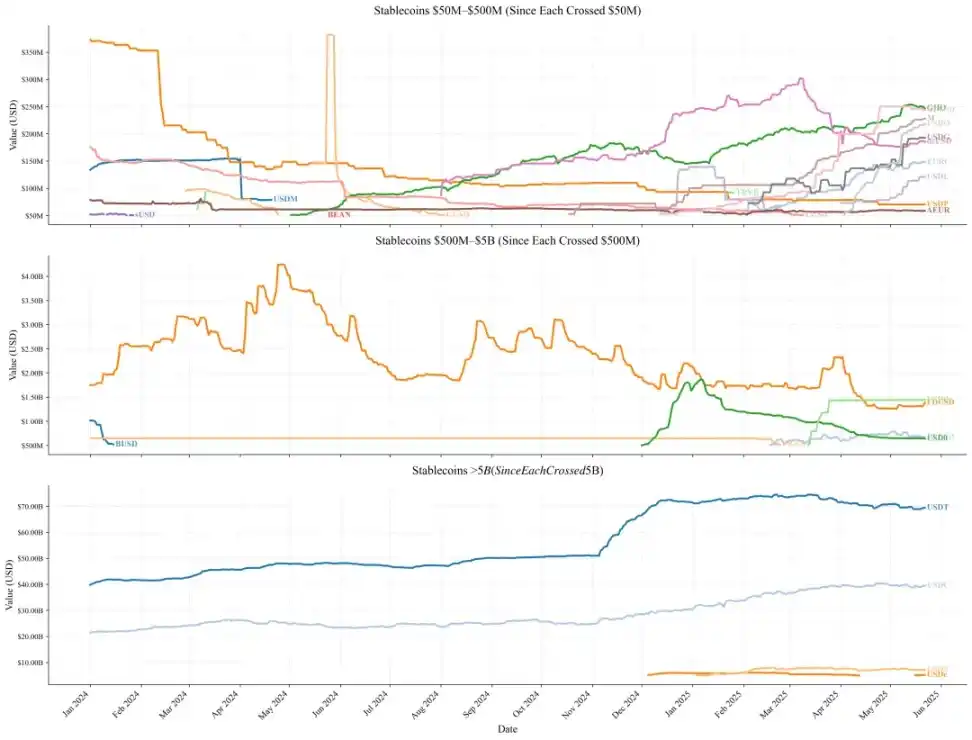

In view of the structural impact that the GENIUS Act will have on the regulatory framework for stablecoins, it is important to systematically examine the development trajectory of the Ethereum stablecoin market. Since 2024, the sector's total market capitalization has continued to show a solid upward trend, maintaining a resilient monthly growth pace, albeit at a slightly slower pace than other RWA segments.

IOSG

small projects (< $500 million) experienced a sustained contraction in early 2024. However, towards the end of 2024, the market value of most projects continues to rise, and the market value of GHO, M, USDO continues to grow. At the same time, a number of new stablecoin projects have emerged across the 50 M market capitalization, the Ethereum stablecoin ecosystem projects are more diverse, and the small-capitalization projects have continued to prosper since 2025.

Medium-sized projects ($5-$5 billion) will only have FDUSD and FRAX in 2024; BUSD plummeted from $1 billion in January 2024 to less than $500 million in March 2024 due to the termination of the offering. However, in 2025, USD 0 and PYUSD will both break through the $500 million threshold, and mid-sized stablecoins will be more diversified.

The top stablecoins (> $5 billion) continue to be dominated by USDT and USDC: USDT stabilized at $40 billion for most of 2024, jumped to $70 billion in early December, and then gradually stabilized until the recent decline in market capitalization; USDC has steadily grown from $22 billion in January 2024 to $38 billion in May 2025. At the beginning of 2025, USDS and USDe both exceeded $5 billion, but USDT and USDC are still far ahead in terms of market share.

RWA.xyz, IOSG

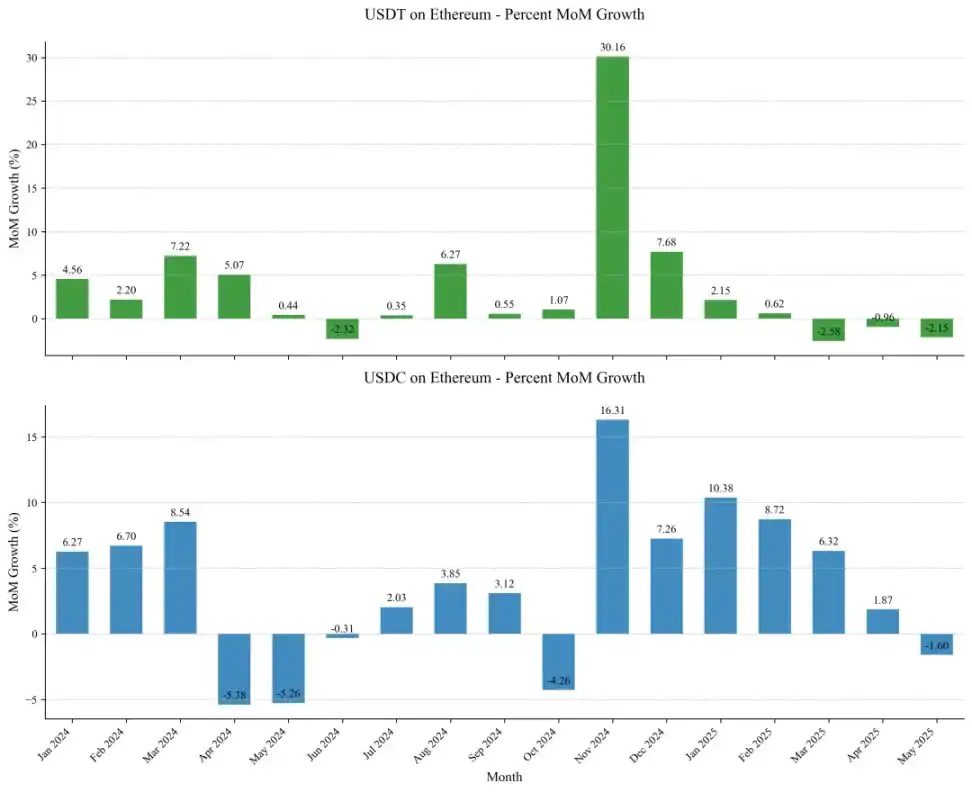

USDT and USDC occupy an absolute dominant position, which directly affects the entire stablecoin ecosystem.

Thegrowth in November 2024 is particularly noteworthy: USDT surged 30.16% month-on-month and USDC grew by 16.31%. This spike was followed by months of growth, with USDC growing more solidly in subsequent months, all of which grew by more than 5% per month. According to the issuer, Tether attributed this to "the influx of collateral assets on exchanges and institutional desks in response to the expected surge in trading volumes"; Circle highlighted that "USDC circulation increased by 78% year-on-year... In addition to user demand, it is also due to the rebuilding of market confidence and the improvement of the standard system driven by the regulatory rules of emerging stablecoins."

However, there has been a clear shift in market momentum recently – USDT on the Ethereum chain has stalled in the past four months, and USDC has declined for the first time in May 2025 after months of growth. This phenomenon may signal that the market is moving towards a new phase of the cycle.

RWA.xyz, IOSG

L2 EcosystemIn

the broader RWA ecosystem, Ethereum maintains absolute dominance with a market share of 59.23% (excluding stablecoins), but it still faces key challenges.